tax abatement nyc meaning

Building management boards of directors or other official representatives must apply for the co-op or condo abatement on behalf of the eligible building units. Usually the tax break goes with the property as long as the project continues to qualify.

What Is The 421g Tax Abatement In Nyc Hauseit

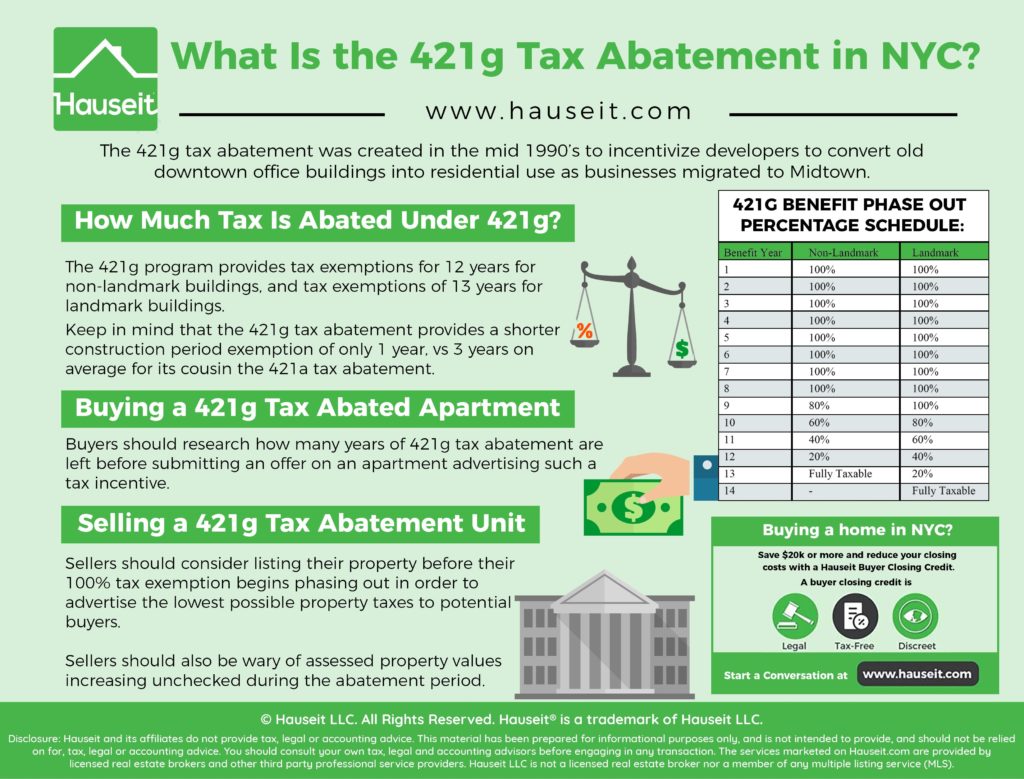

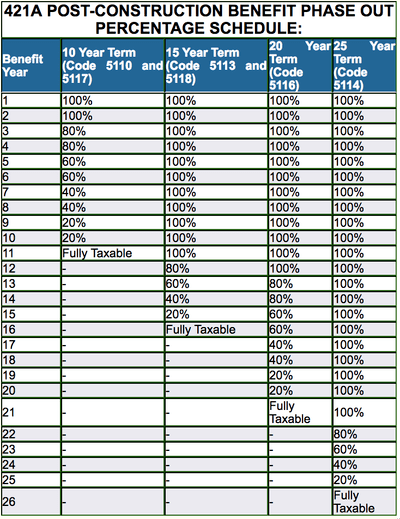

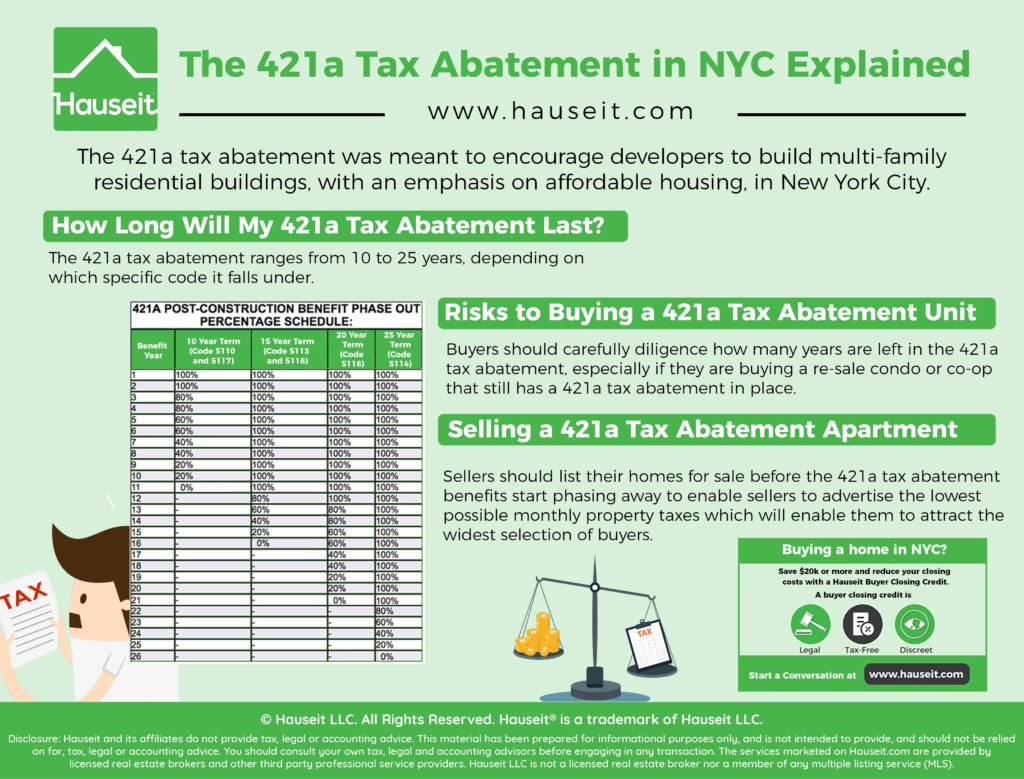

This program provides abatements for property taxes for periods of up to 25 years.

. An abatement is usually requested by property owners who feel that the tax assessment is too high. Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. Abatement of 30 chit means transaction whether called chit chit fund chitty kuri or by whatever name by or under which a person enters into agreement with a specified number of person that every one of them shall subscribe a certain sum of money by way of periodical installments over a definite period and that.

In essence its a tax exemption program given to building developers that typically lowers the property taxes for residential units for some time. Taxpayers should understand the difference between tax abatement and tax penalty abatement to avoid confusion. In most jurisdictions there are multiple programs that abate property taxes if a person or the property is eligible.

Definition of tax abatement. Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill. The abatement is intended to promote affordable.

The hearing was held on March 24 2022. If youre shopping around for a co-op or condo in NYC youre bound to encounter some real estate jargon in listings. Abatements can last anywhere from just a few months to multiple years at a time.

Tax abatement nyc meaning. What Is a Tax Abatement. Define Tax Abatement Program - The term.

A debit for the amount of the building assessment as well as a credit in the amount of the co-op tax. Low- to middle-income residents are usually the target demographic for these programs. Cons of 421a tax abatements for nyc home buyers.

Co-op and condo unit owners may be eligible for a property tax abatement. Tax Abatement Program shall mean Title 4 of The New York Real Property Tax Law. Although towns and cities typically offer.

The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York. Homebuyers can understand the true meaning of the abatement by knowing when it will expire. Perhaps the most well-known is the 421a abatement which recently expired but gave developers and.

A 421a tax abatement lowers your property tax bill by applying credits against the total amount you owe. The short answer is likely going to sting so lets rip this bandage off early. Typically the goal of these programs is to encourage development or renovation of residential properties in specific areas of the city.

A residential tax abatement program is a reduction of a real property tax bill imposed on specific properties by a local government like New York City. For one there are many different types of abatements given to buildings for different reasons. Tax abatement nyc meaning.

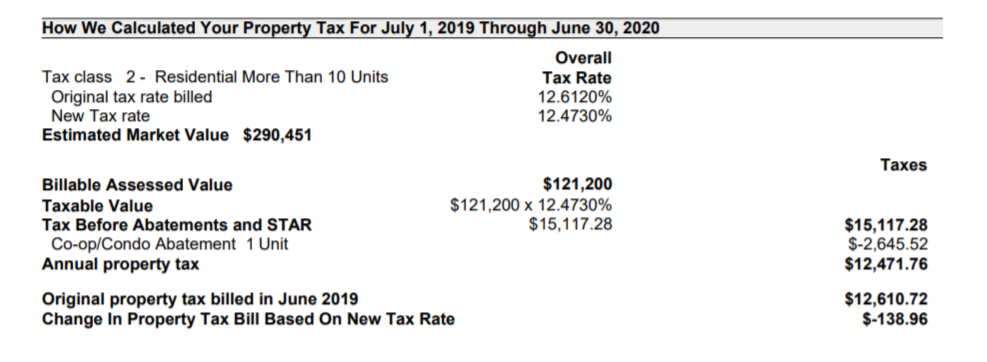

Of course in practice its a little more complicated than that. Tax abatement involves real estate properties while tax penalty abatement involves a taxpayer asking the IRS for a reduction or elimination of tax penalties for late tax payments or incorrect amount of taxes paid. This abatement is a property tax reduction of 175 to 281 for eligible co-op and condo owners who use their apartment as a primary residence.

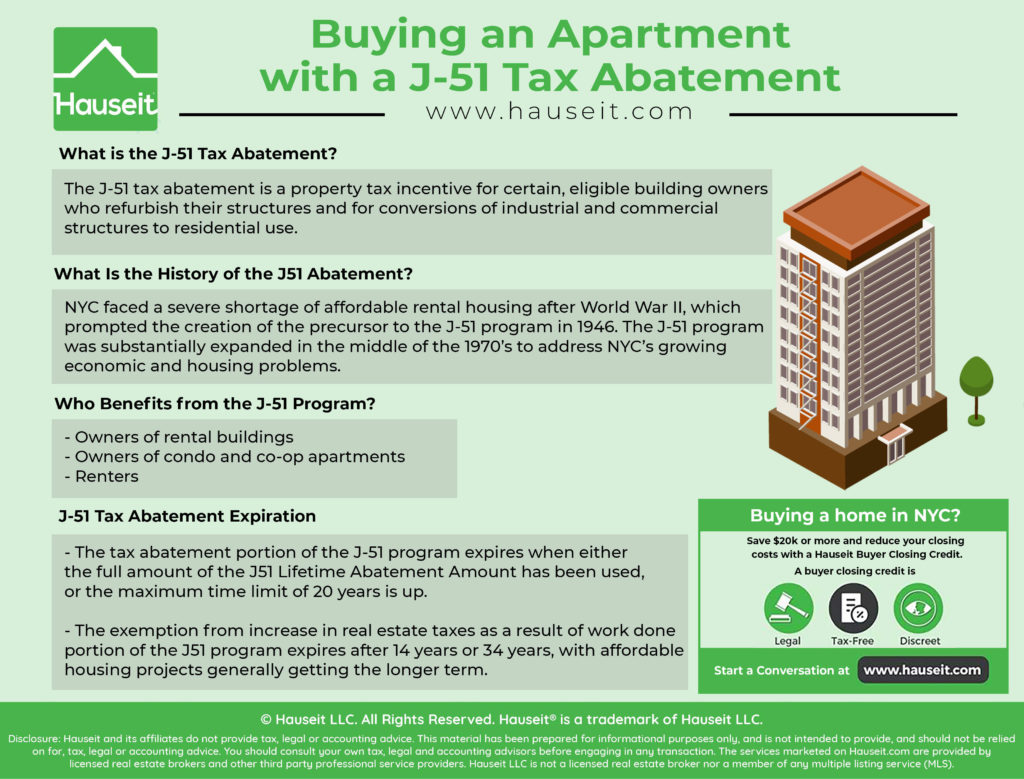

A J-51 abatement is a form of tax exemption that freezes the assessed value of your structure at the level before you started. An amount by which a tax is reduced. There are multiple variations of the 421a tax abatement ranging from terms of 10 to 25 years.

ICAP replaced the Industrial Commercial Exemption Program ICIP which ended in 2008. To be eligible industrial and commercial buildings must be built modernized expanded or otherwise physically improved. Co-op shareholders who are being assessed generally see two transactions on their monthly co-op maintenance statement.

Programs offering residential property tax breaks allow governments such as in New York City to impose fewer. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area. A break on a building or apartments property taxes.

The exemption also applies to buildings that add new residential units. Abatements reduce your taxes after theyve been calculated by applying dollar credits to the amount of taxes owed. The New York City Department of Finance proposed an amendment to the departments rules concerning the Partial Tax Abatement for Residential Real Property Held in the Cooperative or Condominium Form of Ownership.

A tax abatement is a reduction of municipal property taxes like that in New York City that occurs due to specific properties in an areaDevelopment or renovation of residential properties in specific areas of the city are the targets of these programs. The J-51 tax abatement is an exclusive tax benefit given to some building owners. Put simply a tax abatement is exactly what it sounds like.

In most jurisdictions there are multiple programs that abate property taxes if a person or the property is eligible. What is a 421a Tax Abatement In NYC. The tax abatement was meant to encourage developers to build multi-family residential buildings with an emphasis on affordable housing in New York City.

What Does Tax Abatement Mean Nyc. The NFP ICIP and ICAP 2022-23 renewal period has begun. You can still submit comments to the Department of Finance through the NYC rules website.

In New York A Tax Abatement System Lets You Do Business Under A Percentage Of Your Income Rather Than Going To Court. What Is Tax Abatement Nyc. In NYC 421-a tax abatements were introduced in 1971 and were implemented to encourage developers to develop unused and underutilized land by offering them reduced property taxes for a set amount of time typically between 10-25 years.

The agreement details how the local government will reduce property taxes for an improvement an individual performs to a home or development a company contributes to the local economy. One of those perplexing terms is 421a tax abatement. It is most commonly granted to property developers in exchange for including affordable housing and the benefit lasts for 10 to 25 years.

What Is The 421a Tax Abatement NYC. To be eligible for this benefit you must have renovated your structure or plan to convert an industrial or commercial structure into a residential building. In New York State a 421a Tax Abatement is a tax exemption for real estate developers who build multi-family residential buildings in New York City.

Buying An Apartment With A J 51 Tax Abatement Hauseit

What Is The 421g Tax Abatement In Nyc Hauseit

New York Tax Abatements Understanding 421 A Brownstoner

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

What Is A 421a Tax Abatement In Nyc Streeteasy

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

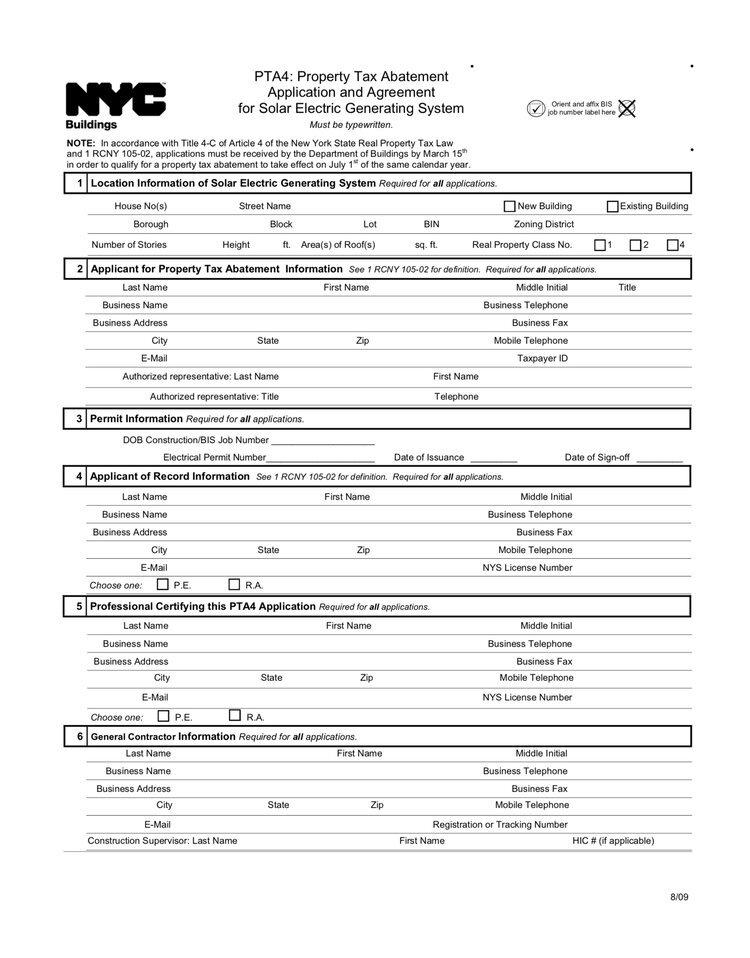

Nyc Solar Property Tax Abatement Pta4 Explained 2022

Tax Abatement Nyc Guide 421a J 51 And More

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

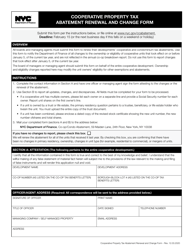

New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

The 421a Tax Abatement In Nyc Explained Hauseit

Nyc Real Estate Taxes Blooming Sky

End Of Tax Break Program May Blunt Impact Of New York Zoning Change The New York Times

How Much Is The Coop Condo Tax Abatement In Nyc

How Much Is The Coop Condo Tax Abatement In Nyc

In New York City The Last Of Condos With 421 A Tax Abatements About To End La Voce Di New York